Before approving a mortgage, lenders will want to see how well you have paid your debts and bills in the past. To do this, they consider your credit history (credit report) from a credit bureau. This tells them about your financial past and how you have used credit. At the first thought of borrowing any money - if you have any doubt - we recommend that you get a copy of your own credit history and examine it to make sure the information is complete and accurate.

A credit report is a history of how consistently you meet your financial obligations. A credit report is created when you first borrow money or apply for credit. On a regular basis, the companies that lend money or issue credit cards to you (banks, finance companies, credit unions, retailers, cell providers, etc.) send to the credit reporting agencies or bureaus (Equifax and TransUnion) specific and (hopefully) factual information about their financial relationship with you, including when you opened the account and if you make your payments on time, miss payments or have gone over your credit limit. Credit bureaus receive this information directly from the financial and retail institutions and retain it to help other lenders make decisions about granting you credit. Your credit report is a history that will help lenders determine what kind of lending risk you are and if you are likely to repay your obligation on time.

In Canada, most provinces have credit reporting legislation to outline practices that must be adopted by credit reporting agencies and the users of consumer credit information to protect the rights of consumers.

It is important to understand that a credit reporting agency like Equifax is simply a records keeper - they only report what credit issuers submit to them, and mistakes can and do happen. The main point that I like to stress is that the both the credit reporting agencies and the credit issuers are required by law to report the truth, whatever that happens to be.

Below is a list of the major sections found in a credit report.

Your credit score, also referred to as a “FICO score” after the mathematical formula created by Fair, Issac and Company or a "Beacon Score" by Equifax, is a statistical formula that translates personal information from your credit report and other sources into a three-digit score. The credit score is used by most companies as a quick way to decide if the applicant is a good credit risk or not. Equifax and TransUnion will calculate the numbers from the credit report and generate a number between 300 and 900. A low score indicates a bad risk. A score of - say - 700 or more puts the applicant in the lenders’ good books. Most "A" lenders want to see a a primary applicant with a credit score of at least 650 to 680.

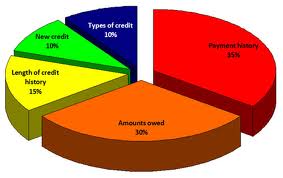

Here is an illustration of how your score might be calculated:

|

In this section, we quickly review what things lenders are looking for to approve your credit, and things that might create problems. If you want to keep score, grab a piece of paper and a pencil and note the number of Probably OKs and how many Potential Problems. After this section, there are More Resources which you can explore further.

To perform the following self-review for Credit, note how many Probably OKs and how many Potential Problems

# Probably OKs?______

# Potential Problems?______

To qualify for a mortgage today you should have2 or more OKs, and no potential problems.

It is important to know that there are many mortgage lenders and each lender publishes specific guidelines as to what credit score or history is acceptable to them. Some even cater to credit-challenged borrowers with 20% down payment or equity. While one lender might say no, another might say okay. A mortgage broker can help identify and short-list which lenders are more favourable than others for your situation.

As a mortgage broker, I constantly talk to clients, especially young people trying to get a mortgage to buy their first home, only to discover they don't have any credit history established or the credit history they do have is insufficient or tarnished. It takes time and effort to create or mend your credit score, so start early.

It is assumed that most of us cannot afford to pay cash for a home, so a mortgage become necessary to raise the appropriate amount of funds for a purchase. Credit Score is a major determining factor in lenders deciding whether you get the best mortgage rate or a REJECTED on your mortgage application. If you are preparing to buy a new home or re-mortgage, here are a few tips to make sure your credit score supports your financing plans.

1. A person needs active trade lines to get a credit score. Trade lines can be credit cards, lines of credit, loans, car leases etc. Rent and paying utility bills does not show up on your credit bureau (unless you don't pay!) so they don't create or increase your score!

Here's the simple truth - you must have a track record showing that you borrow and repay loans and credit cards on time and as agreed to create a history of your healthy debt repayment habits! Use the credit you have regularly to establish and/or maintain a credit history. For example, use your credit card for gas, groceries, or one small purchase every month and pay it off every month on the regular billing date (no sooner). Having no credit history diminishes trustworthiness in eyes of the credit bureau <-that's bad! Avoid opening accounts without intention of using them.

2. Obtain at least 2 trade lines (credit cards, loan, etc.) with at least a $2500 maximum limit between them. Under $2500, the lender may not take the credit card activity seriously. Consider a credit card only for use at a grocery store or a fuel/gas card if you are worried about over spending.

3. Pay bills on time as agreed. Late, missed and unpaid bills lower your score, even if one day late. We highly recommend that you set up automatic payment and overdraft protection on your bank account so that you never miss or bounce a payment. (Paying one day late is NOT paying as agreed!)

4. Think twice about allowing someone to credit-check you. Multiple checks in a short time frame lowers your score, as it makes you look like you NEED money, called "credit hunting". Further, when a “B” lender (say a pay-day-loan company) checks your credit, that may drop your score more than when an “A” lender, such as a bank, checks your score.

5. Never max-out your credit cards. Stay between 0% and 50% of your card limits for the best score and below 75% for next best score. High relative balances (called a "utilization rate") will lower your score. Going over your limit is a 30-40 point score killer! And know that high credit balances will also impact the amount of mortgage for which you can qualify, not to mention harm your score!

6. Finally,treat your credit like an asset,which, with due care and attention, can maximize your buying power.

General

How to Access Your Credit Reports

Free Guide - Understanding Your Credit Score

Complimentary Credit Report Review Service

Understanding Your Credit Rating So That You Can Get a Mortgage

Return to 'Can You Get a Mortgage' Overview

How to Improve Your Credit Rating

Free: Credit Score Improvement Program

How Secured Credit Cards Can Help You Get Your Credit Score Back

"Prove it or Remove it" - Fix Your Credit with the Credit Reporting Act

How to Improve your Credit Score Fast

How is Your Credit Score Calculated?

Bankruptcy, Credit Counselling, Consumer Proposal

Can you get a mortgage after bankruptcy?

How does a Consumer Proposal affect getting a mortgage?

Multiple Bankruptcy – Is there any Mortgage Hope?

Richards Mortgage Group

73 Riverview Circle

Cochrane, AB T4C1K3

Canada

T: 587.774.6290

TF: 1.888.540.1715

Fax: 587.315.6117

Email: inquiry@ richardsmortgagegroup.ca

Quantus Mortgage Solutions

5053 11 St SE

Calgary, AB T2H1M7

Canada

T: 403.238.3111